Buying Versus Renting a Marin Home

The New York Times published a very sensible article regarding the real estate market and its impact on home buyers and renters: “Four Not-So-Obvious Things to Consider When Deciding to Buy or Rent.”

For your convenience, here is our summary as it applies to buying or renting a home in Marin County, CA.

Advantages of Owning a Home

There are three main advantages to home ownership and investing in real estate:

- You can stop worrying about rent increases.

- You will have a forced savings plan.

- You will increase your equity as home prices increase.

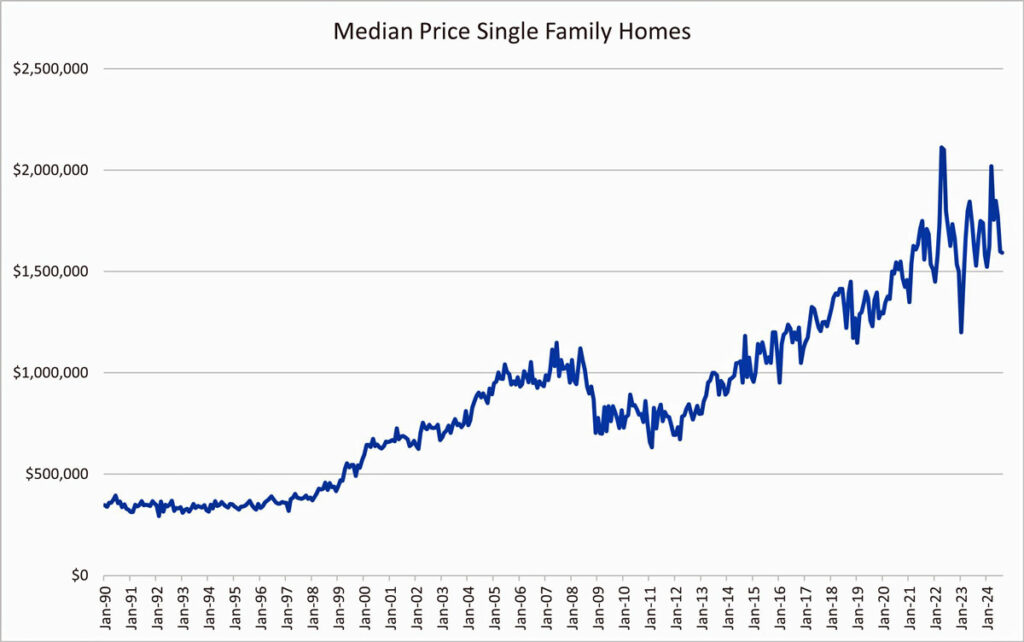

Except for a four-year setback (because of the mortgage industry meltdown in 2009-2013), home prices in Marin have increased steadily over the last 25 years. Given that new home construction is very limited by the lack of land to develop (over 80% of our county is preserved as open space), it is likely that house prices will continue to rise. This trend is shown in this graphic.

There are also tax benefits in owning real estate:

- Your down payment is making money for you, and this is profit tax free until you sell and may have a capital gains tax. If you put this in investments, you would have to pay annual income taxes on the interest.

- Capital gains are protected when you sell: the first $250,000 in gain for a single person and first $500,000 for a married couple is tax free.

- You can claim a home mortgage deduction on your income tax returns.

Disadvantage of Owning a Home

Maintenance cost may come unpredictably and in large amounts.

Advantages of Renting a Home

Renting a home also has advantages, including:

- Renting means you don’t have to worry about the unpredictable costs of maintaining a home. Maintenance costs should be built into the rent that you pay each month.

- You can live in Marin without the cost of a down payment.

Disadvantages of Renting a Home

Rents are likely to increase since the housing supply is limited.

Find Out the Best Financial Option for You

The New York Times provides a calculator to assess the economics of rent versus buy. You provide the present value of a home, how long you intend to live there, details of your mortgage, and more. We used this calculator for a 3 bedroom, 2.5 bath home in central Marin that would sell for $2M or rent for $7,000 per month. There are other variables, like the amount of down payment and interest rate. Here are some estimates with a 30 year mortgage and 20% down:

- With a 6.5% mortgage, the cost of buying or renting over 10 years is about the same.

- With a 5% mortgage, buying can save you about $20,000 a year over 10 years.

If you cannot view the NY Times article on “rent versus buy” and their calculator, you can subscribe for a short time at $1 per week.